web-slide.ru Prices

Prices

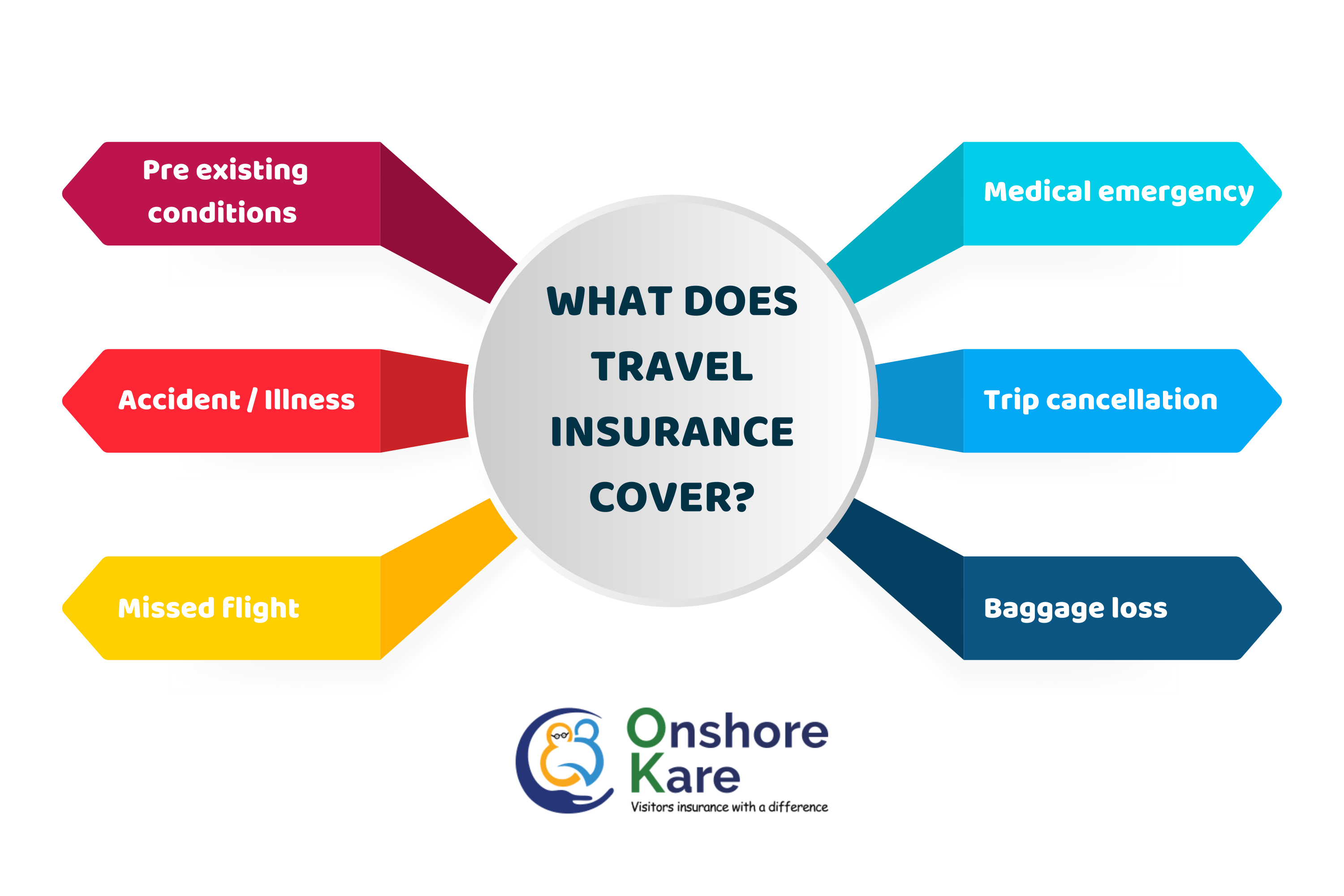

International Travel Insurance Price

Typically, the cost is five to seven percent of the trip cost. You can get a free quote for your personalized travel insurance plan or call our representatives. Why Purchase Travel Insurance? Depending on your major medical coverage, your medical insurance may not cover expenses you incur while traveling internationally. Cost of travel insurance: Travel insurance usually costs between % of a trip's price. For example, for a trip that costs $5,, travel insurance could. Want travel insurance for your next trip? Travelex insurance for travel offers coverage for trip cancellations, medical costs, and more. Get a quote now. We'll match you with the right plan at a price you can afford. Nationwide has been named the best cruise travel insurance company by web-slide.ru In most cases, you can get moderate coverage for $50 or less per person. How much travel health insurance do I need? Coverage needs depend on personal. Quote, Compare, and Purchase Travel Insurance. Compare top plans and providers to find the right travel insurance for your unique trip. Get A Quote Compare. Start by considering the details of your trip and what's most important to you when you travel. Travel Insured International offers a variety of benefits under. The average cost of travel insurance for a visit to the United States can range between $ to $ Depending on your individual needs and the coverage you. Typically, the cost is five to seven percent of the trip cost. You can get a free quote for your personalized travel insurance plan or call our representatives. Why Purchase Travel Insurance? Depending on your major medical coverage, your medical insurance may not cover expenses you incur while traveling internationally. Cost of travel insurance: Travel insurance usually costs between % of a trip's price. For example, for a trip that costs $5,, travel insurance could. Want travel insurance for your next trip? Travelex insurance for travel offers coverage for trip cancellations, medical costs, and more. Get a quote now. We'll match you with the right plan at a price you can afford. Nationwide has been named the best cruise travel insurance company by web-slide.ru In most cases, you can get moderate coverage for $50 or less per person. How much travel health insurance do I need? Coverage needs depend on personal. Quote, Compare, and Purchase Travel Insurance. Compare top plans and providers to find the right travel insurance for your unique trip. Get A Quote Compare. Start by considering the details of your trip and what's most important to you when you travel. Travel Insured International offers a variety of benefits under. The average cost of travel insurance for a visit to the United States can range between $ to $ Depending on your individual needs and the coverage you.

Atlas Premium provides the same benefits as our popular Atlas Travel plan with increased limits for many benefits. If you're worried about things that could go. Affordable International Policies Our travel insurance policies will not cost you too much. You can enjoy care-free travel for as little as INR per day. CFAR coverage typically adds 40% to your standard travel insurance price. The actual cost is influenced by the age and number of people traveling, how long the. Help protect your trip with a travel protection plan that includes trip cancellation, baggage, and medical insurance benefits. Get a quote today! While travel insurance costs vary, the average is somewhere between % of your total trip cost*. If you're on the fence, then consider this: an emergency. Travel insurance quote form. Do you want to insure trip cost as well as the health of the traveler? Yes. Our Plans. Protect your trip from unforeseen events while traveling. Be it domestic or international, get a quote and compare our three plans that includes. When you're covering the cost of a vacation, the thought of paying for health insurance during international travel may seem like an unnecessary expense. Peace of Mind That Travels With You. Just a click away. You may have great healthcare coverage in the U.S., but most of these benefits don't extend overseas. Travel Insurance - Buy best travel insurance in India from top travel companies starting @ ₹30/day*. ✓ Cashless medical facility ✓ No medical test. In , the average international travel insurance policy cost travelers roughly $ However, there are ways to lower your premium, such as electing for. It is recommended that each traveler should buy their own separate travel insurance. The cost of the travel insurance will vary depending on the total coverage. How Much Does International Travelers Insurance Cost? · Trip destination · Length of trip · Traveler’s age · Policy maximum · Deductibles · Benefits · Pre-. Features: Great rates starting at $ per day. Meets Department of State requirements, and many university international student and study-abroad program. Trawick International · World Nomads Travel Insurance · AXA Assistance USA · Generali Global Assistance · Seven Corners · Allianz Travel Insurance · IMG Travel. The average cost of travel insurance is 5% to 6% of your nonrefundable trip expenses. To insure a $1, trip, for instance, costs an average of $61 (6%). Whether you're planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip. Secure your overseas trip with Travel Medical Insurance. Get your Travel How much will overseas Travel Insurance cost? The cost will depend on the. The average cost of travel medical insurance is about $5 per day, according to data from Squaremouth. This average is based on policies purchased in , for. Monthly rates ranging from $40 to $60 are also available, and can sometimes provide better value. Emergency medical plans are surprisingly affordable at about.

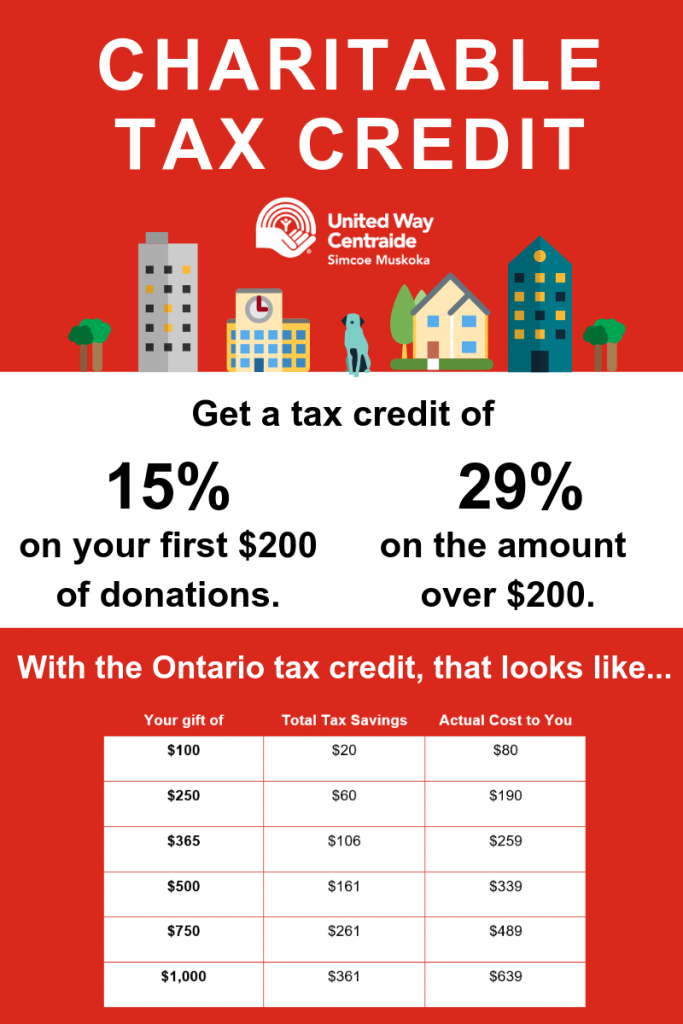

Donation Tax Credit 2021

In addition, the charitable contribution deduction limit for a gift of cash to a public charity is now back to 60 percent of one's adjusted gross income as the. Taxpayers can donate all, or a portion, of their personal income tax refund to any or all of the 29 charities approved by the Charitable Checkoff Commission. A temporary change in the law means that single filers can deduct up to $ for cash contributions made to qualifying charities without itemizing deductions. The donor may not direct or designate donations to a parent, legal guardian, or specific qualified education provider. The amount of the credit allowed is equal. The Strong Families Tax Credit Program was established in to support eligible charitable organizations that provide services focused on child welfare and. Award Year %. In , only 13 of 27 reported eligible Farm to. Food donors applied for a tax credit award. TY Donations and Values by. Commodity. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. For tax years beginning in , an individual who does not itemize deductions may claim a deduction in calculating taxable income (and not as an above-the-line. Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60% of a taxpayer's adjusted gross. In addition, the charitable contribution deduction limit for a gift of cash to a public charity is now back to 60 percent of one's adjusted gross income as the. Taxpayers can donate all, or a portion, of their personal income tax refund to any or all of the 29 charities approved by the Charitable Checkoff Commission. A temporary change in the law means that single filers can deduct up to $ for cash contributions made to qualifying charities without itemizing deductions. The donor may not direct or designate donations to a parent, legal guardian, or specific qualified education provider. The amount of the credit allowed is equal. The Strong Families Tax Credit Program was established in to support eligible charitable organizations that provide services focused on child welfare and. Award Year %. In , only 13 of 27 reported eligible Farm to. Food donors applied for a tax credit award. TY Donations and Values by. Commodity. Your monetary donations and donations of clothing and household goods that are in “good” condition or better are entitled to a tax deduction, according to. For tax years beginning in , an individual who does not itemize deductions may claim a deduction in calculating taxable income (and not as an above-the-line. Charitable contribution deductions for cash contributions to public charities and operating foundations are limited to up to 60% of a taxpayer's adjusted gross.

Applications must be submitted online. You can access the application by clicking the “Apply for a Charitable Contribution Credit” link under the Apply Online. Credit for Contributions to Qualifying Foster Care Charitable Organizations The tax credit is claimed on Form The maximum QFCO credit donation amount for. This was for Tax Years 20only; you cannot deduct charitable cash donations and claim the standard deduction. Food, Clothing, and Household Items. Credit Limit: Not to exceed 3% of average outstanding principal balance of investment during taxable year. Aggregate of charitable investment allowed. Charitable donations to a nonprofit can affect taxpayers, including tax-deductible donations & how much can be claimed in a charitable donation deduction. Tax deduction - Charitable contributions and others March Tax News · State and local taxes. Federal law limits your state and local tax (SALT) deduction to. A taxpayer who both makes qualifying charitable contributions and claims the standard deduction on their federal income tax return for the same tax year can. In the CARES Act allowed for a deduction of $ (or up to $ for married couples filing jointly) for monetary charitable contributions, without the need. For federal income tax purposes, individuals may deduct charitable contributions as an itemized deduction on Federal Schedule A to arrive at federal taxable. The credit is equal to percent of the donating taxpayer's contribution (up to the reserved amount) to the EDO during the tax year for which the credit is. For , the charitable limit was $ per “tax unit” — meaning that those who are married and filing jointly can only get a $ deduction. For the tax. For tax years beginning in , an individual who does not itemize deductions may claim a charitable contribution deduction of up to $ ($ in the case of. Key Takeaways · The IRS allows taxpayers to deduct donations of cash and property to qualified charitable organizations. · Charitable donations must be itemized. For tax year a $ (single) or $ (joint) charitable contribution deduction is not deducted to arrive at adjusted gross income (AGI), but is instead. For conservation easements donated in to , tax credit certificates are issued for 90% of the donated value up to a maximum of $5 million per donation. The charitable deduction subsidizes charitable giving by lowering the net cost to the donor. If the tax deduction spurs additional giving, charitable. In general, contributions deductible for federal income tax purposes are also deductible for Kentucky. Examples of qualifying organizations are: Churches. Any taxpayer (individual, corporation, or trust) that makes a donation of cash or food supplies to a local food pantry, homeless shelter, or soup kitchen may. (ii) Principally directed or managed within the state of Washington. [ c s 9.] NOTES: Automatic expiration date and tax preference performance. A nonrefundable individual tax credit for voluntary cash contributions to a qualifying charitable organization (QCO) , Download · Download, 01/01/

Best Laptop For Trading Forex 2021

Beyond making terrific laptops which offer workstation desktop performance in the portability of laptops, they actually specialize in creating trading computers. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. The best laptops for trading forex are: Lenovo Legion 5 " Gaming Laptop; MSI Stealth 15M Gaming Laptop; LG gram 17” Lightweight Laptop. Create a portable MT4 installation. A big advantage of algorithmic trading is the ability to simultaneously trade a large number of strategies around the. While MT4 is the best for Forex trading, Ninja Trader could be recommended for brokers who specialize in the stock market. Disadvantages. The terminal is. 1 Web-Based Platform, web-slide.ru Awards ; Best Telephone Customer Service, Best Email Customer Service & Best Education Materials/Programmes. What is the best computer for trading stocks? · How much RAM do I need to trade? · Are Macs good for trading? · What is the best trading Laptop? Laptop screen showing web-slide.ru trading platform. FAQs. What information do I Best Forex Platform. ADVFN International Finance Awards Best. I recently made the change to Falcon Computers. They are built for active traders and are state-of-the-art with all the latest components. Which, as you can. Beyond making terrific laptops which offer workstation desktop performance in the portability of laptops, they actually specialize in creating trading computers. Invest with the multi-asset platform that revolutionized trading. Join millions of investors worldwide who share their ideas and strategies in a community. The best laptops for trading forex are: Lenovo Legion 5 " Gaming Laptop; MSI Stealth 15M Gaming Laptop; LG gram 17” Lightweight Laptop. Create a portable MT4 installation. A big advantage of algorithmic trading is the ability to simultaneously trade a large number of strategies around the. While MT4 is the best for Forex trading, Ninja Trader could be recommended for brokers who specialize in the stock market. Disadvantages. The terminal is. 1 Web-Based Platform, web-slide.ru Awards ; Best Telephone Customer Service, Best Email Customer Service & Best Education Materials/Programmes. What is the best computer for trading stocks? · How much RAM do I need to trade? · Are Macs good for trading? · What is the best trading Laptop? Laptop screen showing web-slide.ru trading platform. FAQs. What information do I Best Forex Platform. ADVFN International Finance Awards Best. I recently made the change to Falcon Computers. They are built for active traders and are state-of-the-art with all the latest components. Which, as you can.

Finding the best Forex broker is not easy, and the best thing the traders can do is to compare a few just like we did in this lecture. Meet the Quantower — a multi-asset & multi-connect trading platform for any trader and free to start Download. author thumb By Nial Fuller in Forex Trading Strategies By Nial Fuller June 21st, | 86 Comments The best trading phases or conditions are trending. Meet the Quantower — a multi-asset & multi-connect trading platform for any trader and free to start Download. I bought Matebook 14 few weeks ago. It's amazing and everything trading related works on it. Laptop with web-slide.ru trading charts on the screen. Web trading For more advanced traders, get the best out of the world's most popular trading platform. Voted Best Forex Broker two years in a row (TradingView Broker Awards , ). Awarded highest client satisfaction for mobile platform/app (Investment. Forex Tester is a trading simulator for backtesting. Over 15 years on the market. Fast and reliable. Plenty of features. Lifetime license. Discover the Olymp Trade desktop trading platform, perfect for trading on Windows or Mac. Start investing today on our trading app for PC and see why so. There is no single machine better than the other for the purpose of trading forex. A laptop of any kind is good for a retail trader. Personally. 06, at am. I'm a little confused to why you would recommend a MacBook Pro when the stats clearly indicate most trading programs and apps run off of. Laptop with web-slide.ru trading charts on the screen. TradingView Logo. See Which trading platform is best for you? Compare Platforms. Blue gradient. Fintechee is a Fintech Trading Platform with FIX API. We are Forex White Label provider. Our FIX API Trading Platform is full-featured and EA supported. 06, at am. I'm a little confused to why you would recommend a MacBook Pro when the stats clearly indicate most trading programs and apps run off of. Voted Best Forex Broker two years in a row (TradingView Broker Awards , ). Awarded highest client satisfaction for mobile platform/app (Investment. trading Forex on a smartphone device or laptop. Step 1. Learn about Many of the best currency traders have taken a highly technical approach. Create a portable MT4 installation. A big advantage of algorithmic trading is the ability to simultaneously trade a large number of strategies around the. ○Best New Forex Trading Platforms- Europe. ○Best Forex Trading APP- Asia. ○ Best Mobile Forex Broker of the Year. ○Clients of the XTrend. Best Post-Trade Initiative of the Year (TradeNeXus). Financial News Trading & Tech Awards & Best Foreign Exchange Trading Platform. Our Services.

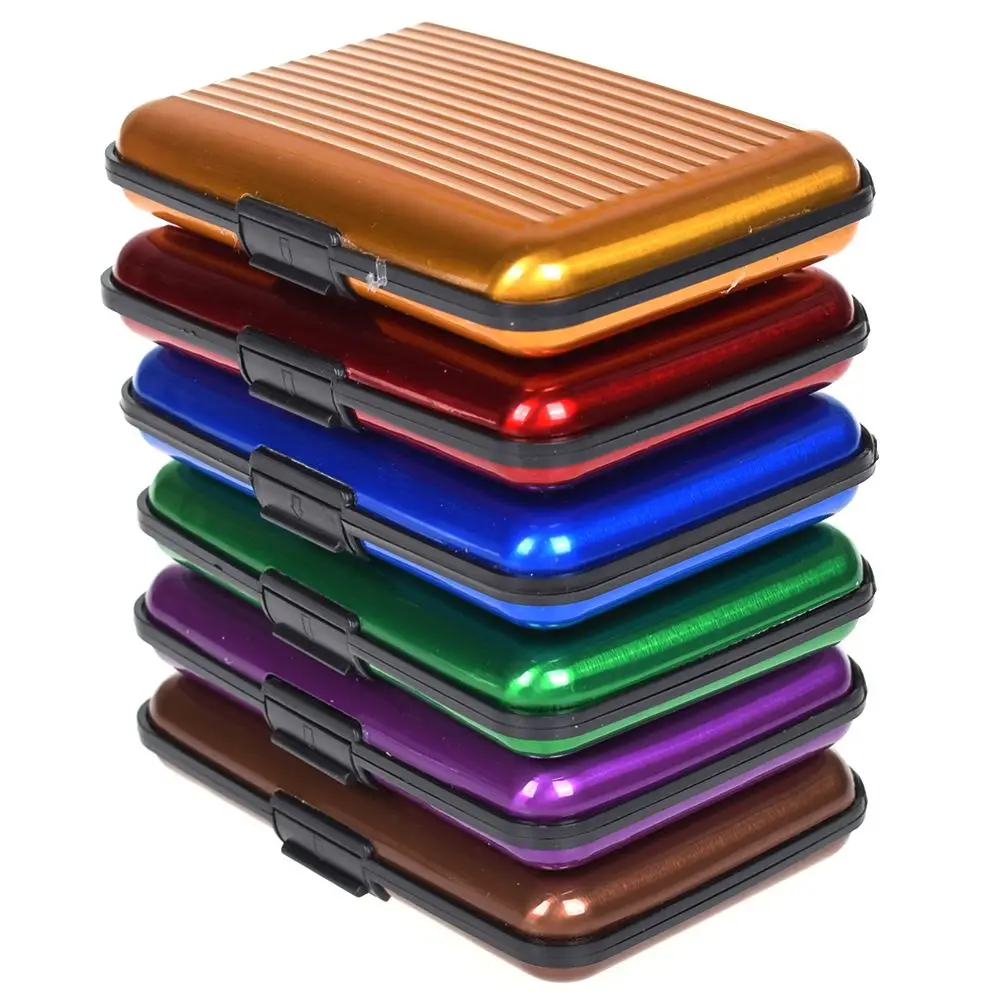

Hard Metal Wallet

Wallets designed for men! Rugged and stylish, these metal wallets are perfect to protect your cards and cash. Traditionally, most wallets are made from leather, as it is a very tough material, while still allowing for flexibility to conform to the rear end, as they are. $ $75 WALLETS · Slim and secure metal wallet body · Unique card lock design · Blocks RFID transmission · Crafted from anodized aluminum · Add up to 3. Carry your business cards or credit cards in style with a sleek engraved metal wallet. Thin, small, large or crushproof metal cases and wallets. The Most Rugged Metal Wallet: Trayvax Contour. The Trayvax Contour is one of the EDC community's first and finest tactical wallets made of metal. This made-in-. Every product we make is one of a kind, made by our team in Elkhart, Indiana. Thanks for your patience as our team works hard to create more unique designs. Minimalist Wallet for Men,Slim Aluminum Metal Wallet with Money Clip, ID Badge Holder, RFID Blocking Credit Card Holder, Hold Up to 15 Cards,Front Pocket. Frida Kahlo Poppies Armored RFID Wallet, RFID Protection Hard Case Card Holder, 6 Pocket Aluminum Wallet, Poppy Floral Wallets for Her. The Best Overall Metal Wallet: Ridge Wallet ; The Best Metal Wallet on a Budget: Hayvenhurst Pop Up ; The Most Premium Metal Wallet: Machine Era Co. Ti5 Slim ; The. Wallets designed for men! Rugged and stylish, these metal wallets are perfect to protect your cards and cash. Traditionally, most wallets are made from leather, as it is a very tough material, while still allowing for flexibility to conform to the rear end, as they are. $ $75 WALLETS · Slim and secure metal wallet body · Unique card lock design · Blocks RFID transmission · Crafted from anodized aluminum · Add up to 3. Carry your business cards or credit cards in style with a sleek engraved metal wallet. Thin, small, large or crushproof metal cases and wallets. The Most Rugged Metal Wallet: Trayvax Contour. The Trayvax Contour is one of the EDC community's first and finest tactical wallets made of metal. This made-in-. Every product we make is one of a kind, made by our team in Elkhart, Indiana. Thanks for your patience as our team works hard to create more unique designs. Minimalist Wallet for Men,Slim Aluminum Metal Wallet with Money Clip, ID Badge Holder, RFID Blocking Credit Card Holder, Hold Up to 15 Cards,Front Pocket. Frida Kahlo Poppies Armored RFID Wallet, RFID Protection Hard Case Card Holder, 6 Pocket Aluminum Wallet, Poppy Floral Wallets for Her. The Best Overall Metal Wallet: Ridge Wallet ; The Best Metal Wallet on a Budget: Hayvenhurst Pop Up ; The Most Premium Metal Wallet: Machine Era Co. Ti5 Slim ; The.

Los Angeles, United States. Brick Red Aluminum Cash Strap Wallet. I have had a leather square wallet that was hard to get the correct card out. The form. Discover thoughtful collections of elevated everyday essentials. Shop wallets, keycases, travel essentials, & more. $ $75 WALLETS · Slim and secure metal wallet body · Unique card lock design · Blocks RFID transmission · Crafted from anodized aluminum · Add up to 3. PROTECT YOUR IDENTITY. This slim aluminum wallet keeps your cards close and your data even closer. The integrated RFID blocking layer fends off data skimmers. 20 Best Metal Wallets · Ridge Wallet · Dango A10 Adapt Wallet · Ekster Aluminum Cardholder Wallet · Trayvax Axis Wallet · Armour Supply Co. Copper · Nimalist Wallet –. Want a minimalist, RFID-blocking wallet? GRID protects your cards and cash. Available in carbon fiber, copper, aluminum and titanium. Get yours today! Forget flimsy alternatives, The Wallet™ by Samson Mfg safeguards your cards and hard-earned cash. The all-metal minimalist design is machined from. Want a minimalist, RFID-blocking wallet? GRID protects your cards and cash. Available in carbon fiber, copper, aluminum and titanium. Get yours today! Carbon Fiber Slim Wallet - Metal Wallet - RFID blocking Wallet | Up to 12 A: It's hard to tell for certain but I suspect it's a hard plastic with a carbon. Wallet, Rfid Wallet - Front Pocket Metal Wallet, Card Holder, Aluminum Hard and Secure: Engineered with precision, our wallet's hard exterior offers maximum. A space-grade aluminum smart wallet built for quick access. This cardholder fans out your cards at the click of a button and the expandable metal backplate. 13 Best Metal Wallets for Men · Ekster Aluminum Cardholder · Dango M1 Maverick Rail Wallet · Hayvenhurst Minimalist Wallet · Trayvax Contour Wallet · Gerber Barbill. RFID Credit Card Holder Metal Wallet 6 Slots Hard Protector Case Brown ; Quantity. 2 sold. 2 available ; Item Number. ; Brand. uxcell ; Type. Card Case. Discover Heavy Metal Merchant's extensive range of heavy metal and hard rock wallets from your favourite bands! Explore now to unlock your inner rock god! hard metal beneath the glossy black surface. It's hard to imagine many In all, The Ridge Wallet is a solid entry into the minimalist wallet race. Metal Wallets. The Axwell Metal Wallet combines a slim design, RFID-blocking technology, and a lifetime guarantee for ultimate security and durability. There's no other wallet like the Fantom. Our fanning technology is patented, and unique to our brand. We worked hard to create this revolutionary wallet. Discover thoughtful collections of elevated everyday essentials. Shop wallets, keycases, travel essentials, & more. Never had any issues with cards being scratched by a metal wallet and I've carried hard to go back. Upvote 3. Downvote Reply reply. Award. Guaranteed to be the best minimalist wallet you'll ever buy. Made % in the USA. Grip the wallet to pop out and access conveniently layered cards.

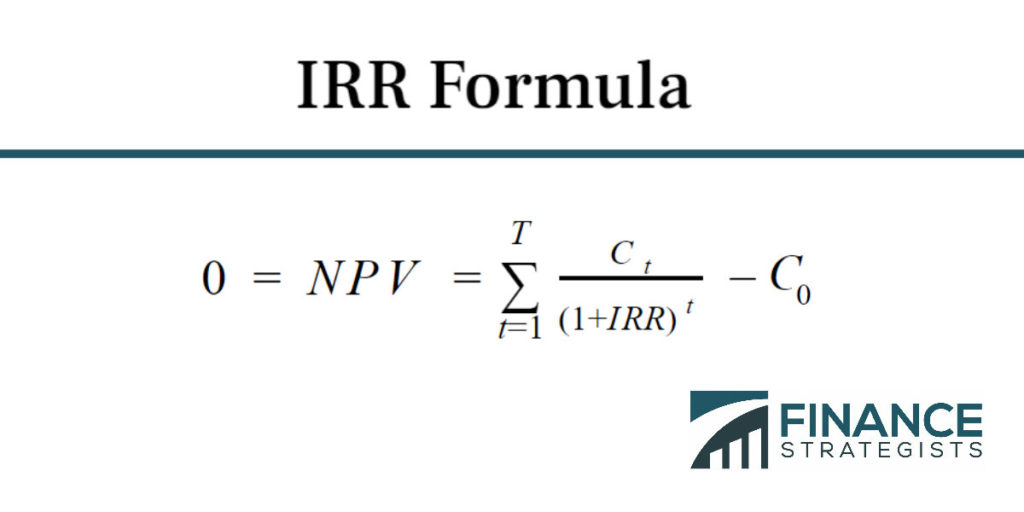

Irr Investment Term

IRR stands for internal rate of return. It measures your rate of return on a project or investment while excluding external factors. IRR is an investment metric that measures the rate at which an investment generates cash flows over time. It is the discount rate that makes the. Internal rate of return (IRR) is a discount rate. In the investing world, a discount rate is used to define the current value of future cash flow. When IRR is. The internal rate of return (IRR), a statistic in financial analysis, is used to figure out how profitable potential investments might be. Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term internal refers to the fact that the calculation excludes. The IRR of an investment is the interest rate that gives it a net present value of 0, or where the sum of discounted cash flow is equal to the investment. The. How to Calculate IRR The internal rate of return (IRR) metric is an estimate of the annualized rate of return on an investment or project. The higher the. The IRR of an investment is the interest rate that gives it a net present value of 0, or where the sum of discounted cash flow is equal to the investment. The. The Internal Rate of Return (IRR) is the rate at which each invested dollar is projected to grow for each period it is invested. IRR stands for internal rate of return. It measures your rate of return on a project or investment while excluding external factors. IRR is an investment metric that measures the rate at which an investment generates cash flows over time. It is the discount rate that makes the. Internal rate of return (IRR) is a discount rate. In the investing world, a discount rate is used to define the current value of future cash flow. When IRR is. The internal rate of return (IRR), a statistic in financial analysis, is used to figure out how profitable potential investments might be. Internal rate of return (IRR) is a method of calculating an investment's rate of return. The term internal refers to the fact that the calculation excludes. The IRR of an investment is the interest rate that gives it a net present value of 0, or where the sum of discounted cash flow is equal to the investment. The. How to Calculate IRR The internal rate of return (IRR) metric is an estimate of the annualized rate of return on an investment or project. The higher the. The IRR of an investment is the interest rate that gives it a net present value of 0, or where the sum of discounted cash flow is equal to the investment. The. The Internal Rate of Return (IRR) is the rate at which each invested dollar is projected to grow for each period it is invested.

Put simply, IRR is used to help judge the profitability and return profile of a potential investment. The IRR of a potential investment is the discount rate or. To calculate IRR, investors must first understand net present value (NPV). In the simplest terms, NPV estimates how much your investment will be worth in the. Internal rate of return (IRR) is a financial metric used to measure the profitability of an investment over a specific period of time and is expressed as a. The internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment). IRR is an annual. IRR is the discount rate for which the net present value (NPV) equals zero (when time-adjusted future cash flows equal the initial investment). IRR is an annual. The Internal Rate of Return (IRR) is the yield an investment generates given a series of cash flows over a period of time. What is the internal rate of return (IRR)?. The IRR is a discount rate used to assess an investment's profitability. Using IRR, the present value of future cash. Simply put, it is the rate of return required for an investment's present value of cost to equal its present value of future cash flows. In discounted cash flow. An IRR is based on estimates of an asset's future sale value and the amount of cash returned over the investment term. However, no one knows exactly how. Internal rate of return (IRR) is a capital budgeting measurement used by companies to determine the profitability of a potential investment or project based on. IRR stands for Internal Rate of Return. It is a way to show your overall effective rate of return for a particular investment. IRR is the internal rate of return at which the investment is expected to grow annually. It is ideal for capital budgeting decisions and when comparing. Internal Rate of Return (IRR). A calculation used to estimate the future value of an investment as if it were valued at the present. IRR is a discount rate that. Internal Rate of Return Definition. Another common investment assessment approach is to calculate the Internal Rate of Return (IRR), which is also called the. Internal rate of return (IRR) is the expected average return of an investment. IRR is commonly used in corporate finance and is similar to the compound annual. return on an annual basis. The IRR financial metric is extremely sensitive to cash flow timing, and long-term investments tend to deflate the IRR as TVM is. IRR, short for Internal Rate of Return, is the expected compound annual rate of return expected to be earned on an investment. In simpler terms, IRR is a metric. IRR stands for “internal rate of return” and is a more complicated way of looking at your returns which takes elapsed time into account as one of the factors. IRR is a rate of return used in capital budgeting to measure and compare the profitability of investments; the higher IRR, the more desirable the project.

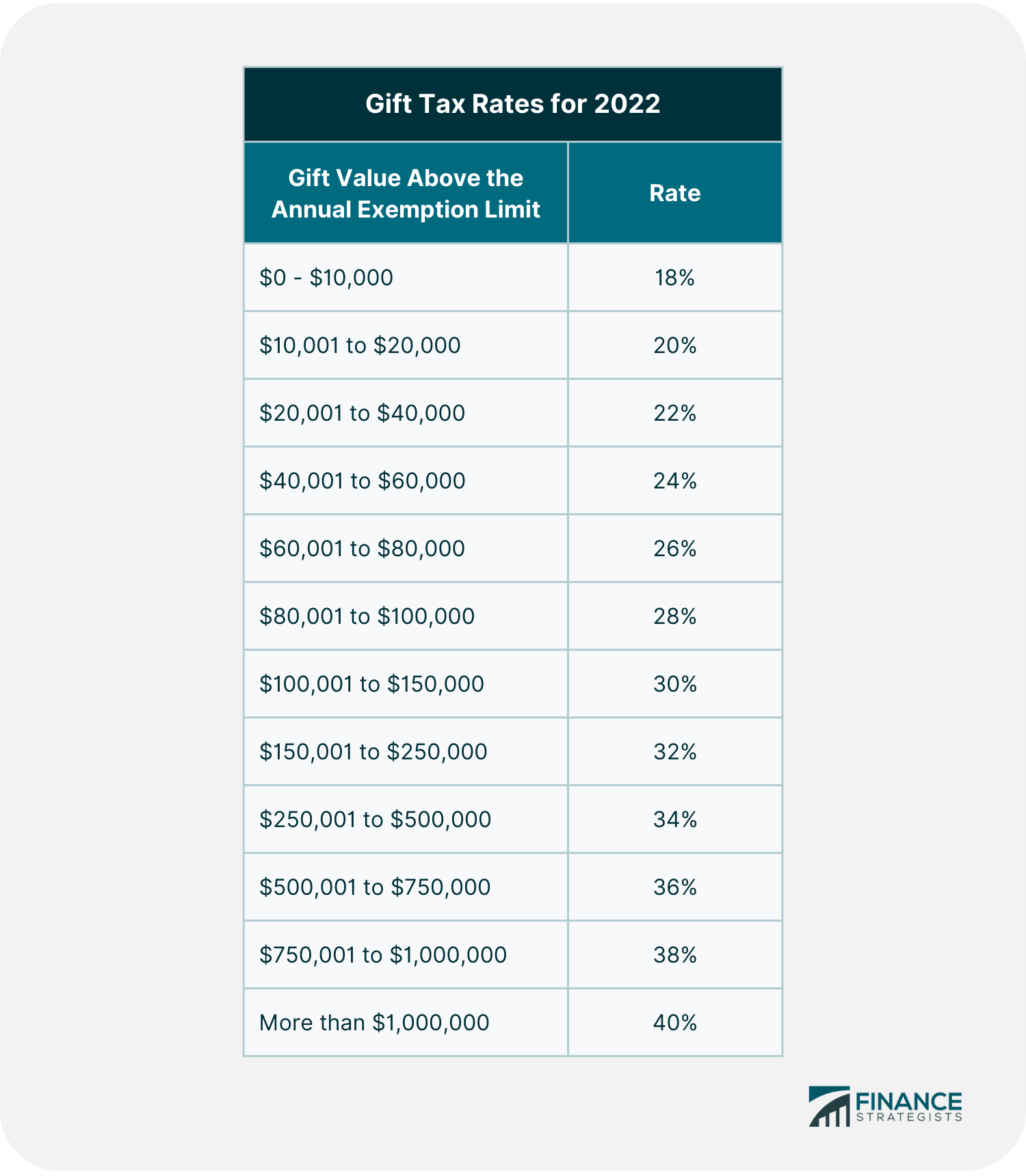

What Is The Gift Tax Limit

For , the annual gift tax limit is $17, per giver per recipient. That means you can give cash or property up to a value of $17, to several different. A married couple may give up to $36, to an individual (a split gift of $18, each). A married couple may give up to $72, to another married couple (a. There is no gift tax until it's over $14,, in a lifetime (from a single person). The $18, is not a tax limit, it's a reporting limit. Gifts that do not exceed the annual exclusion amount ($16, in ) to any one recipient in any given year. What Else Should I Know about the Gift Tax? When. In other words, if you give each of your children $18, in , the annual exclusion applies to each gift. The table below shows the annual exclusion amount. For , the annual gift tax limit is $17, per giver per recipient. That means you can give cash or property up to a value of $17, to several different. Taxpayer A gave $, in gifts split between five individuals in , or $20, each. Because the annual exclusion limit for that year is $17, per. The annual exclusion allows individuals to give up to $15, gift tax-free to the same recipient. · Spouses are entitled to the same annual gift tax exclusion. The gift tax is what the giver pays if they exceed certain gift limits in any given year. The exclusion limit for was $ for gifts to individuals;. For , the annual gift tax limit is $17, per giver per recipient. That means you can give cash or property up to a value of $17, to several different. A married couple may give up to $36, to an individual (a split gift of $18, each). A married couple may give up to $72, to another married couple (a. There is no gift tax until it's over $14,, in a lifetime (from a single person). The $18, is not a tax limit, it's a reporting limit. Gifts that do not exceed the annual exclusion amount ($16, in ) to any one recipient in any given year. What Else Should I Know about the Gift Tax? When. In other words, if you give each of your children $18, in , the annual exclusion applies to each gift. The table below shows the annual exclusion amount. For , the annual gift tax limit is $17, per giver per recipient. That means you can give cash or property up to a value of $17, to several different. Taxpayer A gave $, in gifts split between five individuals in , or $20, each. Because the annual exclusion limit for that year is $17, per. The annual exclusion allows individuals to give up to $15, gift tax-free to the same recipient. · Spouses are entitled to the same annual gift tax exclusion. The gift tax is what the giver pays if they exceed certain gift limits in any given year. The exclusion limit for was $ for gifts to individuals;.

In addition, contributions to a plan can be frontloaded by gifting five years' worth of annual exclusion gifts at once without impacting the gift tax. Contribution limits and types of RRSP investments. Borrowing from an RRSP Tax implications if you receive a gift. If you receive a gift or. For the last six years, taxpayers have benefited from the historically high gift and estate tax exemptions introduced under the Tax Cuts and Jobs Act of Gift Tax Exemption for · Starting on January 1, , the annual exclusion on gifts will be $18, per recipient (up from $17, in ). · Federal. The gift tax limit is $17, in and $18, in Note that this annual exclusion is per gift recipient. So you could give away the limit to several. How the gift tax "exclusion" works. Currently, you can give any number of people up to $18, each in a single year without incurring a taxable gift. The annual gift tax exclusion is $18, per recipient in ($36, for a married couple giving jointly) and $17, in Some examples of situations. Annual federal gift tax exclusion. In , an individual can make a gift of up to $18, a year to another individual without federal gift tax liability. As of , there is a gift exclusion of $17, As a result, a party can make a gift up to $17, per person without paying a federal gift tax. Currently. In December , Congress increased the gift, estate, and GST tax exemptions to $10 million through With indexing for inflation, these exemptions are. Keep in mind that you have other avenues for tax-advantaged gifting beyond that. You can, for instance, use the annual gift tax exclusion — $18, in Federal Estate and Gift Tax Rates and Exclusions ; $5,, 35%. 35%. $13, ; $5,, 40%. 40%. $14, The estate tax exemption is the total amount of gifts an individual can give to others during their lifetime without incurring gift tax. How much can I gift? There is no limit on how much you can give, either fund a gift will be subject to tax at your marginal tax rate. A withdrawal. Contribution limits and types of RRSP investments. Borrowing from an RRSP Tax implications if you receive a gift. If you receive a gift or. The annual gift tax exclusion amount is the amount you can gift per individual and is not subject to federal gift taxes nor required to file a federal gift tax. The Tax Cuts and Jobs Act, which was signed into law on December 22, , increased the gift tax exclusion in to $15, For , the gift tax exclusion. As of , this exclusion is $18, per recipient. Additionally, there's a lifetime gift tax exemption, which allows individuals to give away a certain amount. For , the annual gift tax exclusion is $15, per recipient. That amount will increase to $16, for Accordingly, you can give each family member up. It is important to consider some of the less-obvious gifts when you are advising clients who are intent on using up their full $ million basic exclusion.

Current Personal Loan Interest

Your loan terms, including APR, may differ based on amount, term length, and your credit profile. Current rate range is % to % APR. Excellent credit. Personal Loan Rates ; $0 per transfer · The minimum monthly payment is $10 or 2% of the outstanding balance, whichever is greater, plus all accrued interest, as. With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms Personal loan interest rates as low as % APR. Sikorsky Credit Union in CT offers affordable rates on a secured and unsecured Personal Loans and Lines of Credit to fit your budget. Explore our rates. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Borrow funds or consolidate your high interest debt with a personal loan at a competitive rate. Know exactly what you have to pay each month. interest rates range from % to %. The most credit worthy applicants may qualify for a lower rate while longer-term loans may have higher rates. The. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a.. APPLY PERSONAL LOAN. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. Your loan terms, including APR, may differ based on amount, term length, and your credit profile. Current rate range is % to % APR. Excellent credit. Personal Loan Rates ; $0 per transfer · The minimum monthly payment is $10 or 2% of the outstanding balance, whichever is greater, plus all accrued interest, as. With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms Personal loan interest rates as low as % APR. Sikorsky Credit Union in CT offers affordable rates on a secured and unsecured Personal Loans and Lines of Credit to fit your budget. Explore our rates. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Borrow funds or consolidate your high interest debt with a personal loan at a competitive rate. Know exactly what you have to pay each month. interest rates range from % to %. The most credit worthy applicants may qualify for a lower rate while longer-term loans may have higher rates. The. ICICI Bank offers one of the lowest interest rate Personal Loans with a competitive interest rate at %* p.a.. APPLY PERSONAL LOAN. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees.

As an example, a $20, loan with an interest rate of % for a 5 year term has monthly payments of $ with total interest paid $3, and for a. Our personal loans come with competitive interest rates, flexible terms & no Apply NowCurrent RRSP Loan Rates. Auto Loans. Whether you're buying new. The average personal loan rate for a month loan at a commercial bank was % as of September 6, according to Bankrate. Interest rates on personal loans. Personal loan interest rates currently range from about 8 percent to 36 Homeowners taking on major home improvements may get lower rates than current home. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms Personal loan interest rates as low as % APR. Huntington offers competitive interest rates on personal loans. Find personal loan rates for Ohio, Illinois, Indiana, Kentucky, Michigan, Pennsylvania, West. Current personal loan interest rates by credit score ; · % - % · $5, to $, · ; · % - % · $1, to $50, · ; · -. Personal Loan Options · Personal Expense Loan · Home Improvement Loan · Debt Consolidation Loan · Savings Secured Loan · Certificate Secured Loan. Save on interest with a fixed interest rate from % - % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7. With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher interest credit card. We offer loans from $1, Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. In , the average personal loan interest rate fluctuated. By June, it was %. The rate you pay will depend on the lender and your credit score. And. The annual interest rate on your loan. Your age. Your results. Created with Income verification (a current paystub AND recent T4 slip/final paystub from. A personal loan can help whether you need money for education, a major purchase, or to consolidate higher interest rate debt. For example, if the given interest rate is % and the tenure is 60 months, the EMI for 20 lakhs will be Rs. 42, You can use the Personal Loan EMI. Current Offers. Current Offers. Offers and Discounts. Community Speaker Love your car but not your interest rate? Not to worry, we can refinance it. These rate ranges are current as of 3/06/23 and are subject to change How do personal loan interest rates work? Personal loan interest rates are. current opportunities and scholarships. Funds advanced for non-mortgage loans. Consumer credit, Total, V, , , , , Personal loan. Key takeaways · The current average personal loan interest rate is %. · Excellent credit results in the lowest rates — and poor credit may have rates over

What Will Fed Do With Interest Rates

The Federal Reserve said Wednesday it will hold interest rates at a year high, making borrowing tougher for everything from car loans to mortgages. The Federal Reserve is committed to its goal of 2% inflation. At its next meeting, the Fed is likely to either hold rates steady again or potentially introduce. Why does the Federal Reserve cut interest rates when the economy begins to struggle? The theory is that by cutting rates, borrowing costs decrease. The Federal Reserve is poised to lower the Fed funds target rate after its September meeting. If so, it will be the first rate cut since July In the United States, the authority to set interest rates is divided between the Board of Governors of the Federal Reserve (Board) and the Federal Open Market. You know the fixed rate of interest that you will get for your bond when you buy the bond. How do you find the current value of an I bond? If the bond. On the other hand, if people expect that the Federal Reserve will announce a rate cut, consumers and businesses will increase spending and investment. This can. As expected, the Federal Reserve kept the target range for the federal funds rate at % to % at its July meeting, but it opened the door to cutting rates. For the five central banks that have permanent swap lines with the Fed—Canada, England, the Eurozone, Japan, and Switzerland—the Fed lowered its interest rate. The Federal Reserve said Wednesday it will hold interest rates at a year high, making borrowing tougher for everything from car loans to mortgages. The Federal Reserve is committed to its goal of 2% inflation. At its next meeting, the Fed is likely to either hold rates steady again or potentially introduce. Why does the Federal Reserve cut interest rates when the economy begins to struggle? The theory is that by cutting rates, borrowing costs decrease. The Federal Reserve is poised to lower the Fed funds target rate after its September meeting. If so, it will be the first rate cut since July In the United States, the authority to set interest rates is divided between the Board of Governors of the Federal Reserve (Board) and the Federal Open Market. You know the fixed rate of interest that you will get for your bond when you buy the bond. How do you find the current value of an I bond? If the bond. On the other hand, if people expect that the Federal Reserve will announce a rate cut, consumers and businesses will increase spending and investment. This can. As expected, the Federal Reserve kept the target range for the federal funds rate at % to % at its July meeting, but it opened the door to cutting rates. For the five central banks that have permanent swap lines with the Fed—Canada, England, the Eurozone, Japan, and Switzerland—the Fed lowered its interest rate.

If you receive a federal student loan, you will be required to repay that loan with interest. Make sure you understand how interest is calculated and the. For example, if the federal funds rate is lower than the IORB rate, banks will borrow in the federal funds market and deposit those funds at the Fed to earn a. The Federal Reserve has raised its benchmark interest rate by %. While we don't know for sure what moves the Fed will make with interest rates this year. As a result, the federal funds rate should not fall below the interest on reserve balances rate. Because the interest on reserve balances rate is an. The Federal Reserve has raised its benchmark interest rate by %. While we don't know for sure what moves the Fed will make with interest rates this year. The Fed lowers interest rates in order to stimulate economic growth, as lower financing costs can encourage borrowing and investing. However, when rates are too. When interest rates remain low over time, interest expense on the debt paid by the federal government will remain stable, even as the federal debt increases. As. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for. If you do not allow these cookies, you will experience less targeted advertising. Cookie List. Clear. checkbox label label. Apply Cancel. Consent web-slide.rust. Pure speculation here, but the FED basically said that they do not plan on increasing rates because increased bond yields and a decreased. Selected Interest Rates. Yields in percent per annum. Make Full Screen. Instruments, Aug 30, Sep 2*, Sep 3, Sep 4, Sep 5. Federal. At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by. The Federal Reserve does not set mortgage rates, these rates are set by individual lenders. However, the Fed does set the federal funds rate, which affects. I expect the Fed will cut only 25 basis points, but I anticipate that would only be the start of what is likely to be a very significant easing cycle. In recent. What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to. 'Several' Fed officials were ready to cut interest rates in July, minutes show. With a September rate cut seen as a virtual done deal, questions turn to how. Mortgage rates should continue declining this year as the U.S. economy weakens, inflation cools and the Federal Reserve cuts interest rates. In response, the Federal Reserve started increasing interest rates to cool the pace of rising prices, hiking its benchmark rate 11 times between March and. The federal funds rate is also used as a benchmark for setting the interest rates you can earn on deposit accounts. That includes savings and money market. As the financial crisis and the economic contraction intensified in the fall of , the FOMC accelerated its interest rate cuts, taking the rate to its.

Can You Sue A Company For Not Sending Your W2

If you haven't yet received a W-2, it might also mean that your employer “misclassified” you as an Independent Contractor. This can cost you extra tax and also. It is not legal to send a W-2 form electronically to an employee that has not consented to that delivery, or if the employee has revoked their consent. If an. As an employee, you will not be penalized for your employer's failure to file W-2 forms. However, it is your responsibility to notify the IRS if you have not. If ADOR receives an Arizona income tax return and finds the Social Security Number (SSN) and/or name on the W-2 form do not match the identification number and/. File a wage claim: If direct communication does not resolve the issue, you can file a wage claim with the appropriate labor or employment agency in your. The basic idea is that if you didn't have to sue but had been paid in the ordinary course of events, your taxes should be the same. Claims arising in and about. My employer didn't pay me, what can I do? If you believe your employer owes you $5, or less, you can file a case in small claims court for the unpaid. Failing to report a Form is guaranteed to give you an IRS tax notice to pay up. These little forms are a major source of information for the IRS. Copies go. You can file a complaint online or paper (to be mailed) with the Division within 2 years of the date the wages were earned, or sue the employer in small claims. If you haven't yet received a W-2, it might also mean that your employer “misclassified” you as an Independent Contractor. This can cost you extra tax and also. It is not legal to send a W-2 form electronically to an employee that has not consented to that delivery, or if the employee has revoked their consent. If an. As an employee, you will not be penalized for your employer's failure to file W-2 forms. However, it is your responsibility to notify the IRS if you have not. If ADOR receives an Arizona income tax return and finds the Social Security Number (SSN) and/or name on the W-2 form do not match the identification number and/. File a wage claim: If direct communication does not resolve the issue, you can file a wage claim with the appropriate labor or employment agency in your. The basic idea is that if you didn't have to sue but had been paid in the ordinary course of events, your taxes should be the same. Claims arising in and about. My employer didn't pay me, what can I do? If you believe your employer owes you $5, or less, you can file a case in small claims court for the unpaid. Failing to report a Form is guaranteed to give you an IRS tax notice to pay up. These little forms are a major source of information for the IRS. Copies go. You can file a complaint online or paper (to be mailed) with the Division within 2 years of the date the wages were earned, or sue the employer in small claims.

You can file a complaint even if you no longer work for the employer you are filing a complaint against. It would be nice to get even with someone who misclassified a worker as an independent contractor instead of an employee. However, the law does not allow for. The Department of Labor processes the following types of employment-related complaints. You can visit any of the offices for the Department of Labor and. My employer didn't send me a W-2 form. What should I do? IRC § is entitled, “Civil Damages for Fraudulent Filing of Information Returns.” This section of the Internal Revenue Code allows you to sue someone who. The Department of Labor is a federal agency and does not charge workers or employers for its services. Q: I haven't worked for this employer for a while. How. What can an employee do if an employer does not pay wages to the employee? Failing to report a workplace injury to your employer. In California, you must report your injury to your employer within 30 days of the incident or as soon as. If your employer is not paying the minimum wage or overtime, you can file a claim with the Department of Labor and Industry, Labor Standards unit. Labor. Then, they want to see what your income is now. Well, how do they do that? If you work for a company, you likely get a W2 form at the end of the year showing. You can sue the employer in small claims court, because the statute of limitations on a civil action to collect the unpaid wages is 5 years. See People ex rel. USDOL can assist with minimum wage and overtime claims if you're covered by the Fair Labor Standards Act. · USDOL can assist in cases where your employer is a. Contact the IRS for Assistance: If your employer refuses to issue a corrected Form W-2, you can contact the IRS for assistance. The IRS may be able to help you. Not paid what you're owed? You can sue a company for illegally withholding wages. Hold employers accountable with Morgan & Morgan. No. Labor Code section starts with an assumption that all workers are employees, and provides the test that a hiring entity would have to satisfy to prove. This is one decision by a court in one state. However, this reasoning could potentially apply elsewhere, too. Call an employment lawyer to discuss your own data. Independent contractors are generally not protected by state or federal wage laws. But if your employer wrongly classified you as an independent contractor, you. My employer refuses to give pay stubs – what can I do? If an employer refuses to give an employee a pay stub, then the employee may be able to sue in a court. After sending in your Back Wage Claim Form, it will take the Wage and Hour Division 6 weeks to process it, and then send you a check for your owed wages. Search. Misleading statements can land an employer in court for negligent misrepresentation, fraudulent inducement, or other legal issues. You do not always need an.

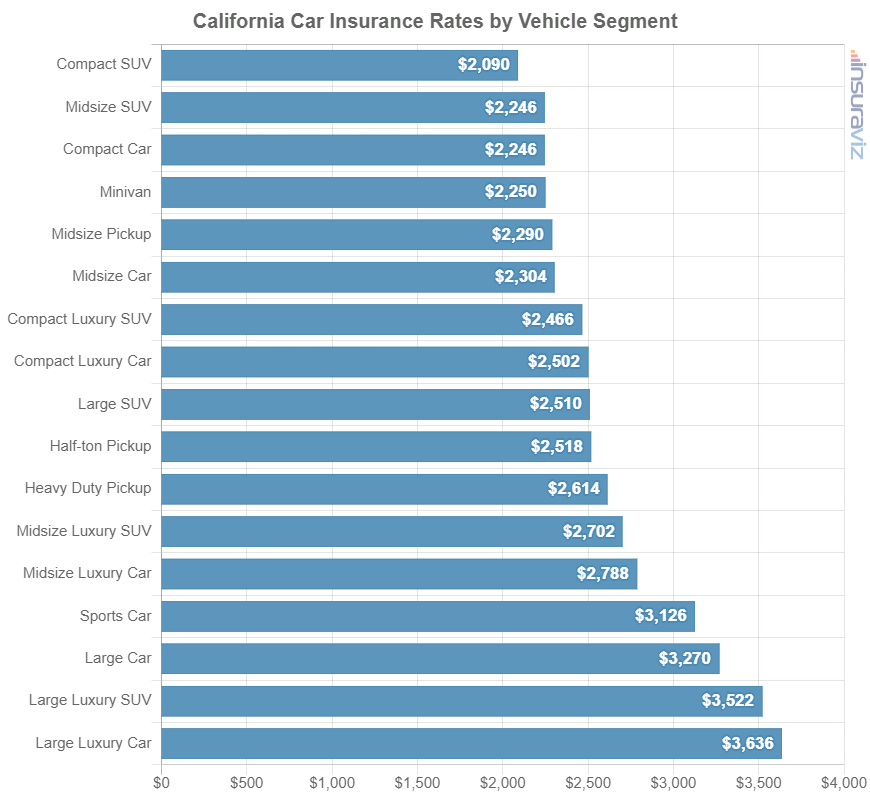

Average California Auto Insurance Cost

California drivers pay an average of $ per month for full-coverage insurance and $ per month for minimum-coverage insurance, according to Insurify's. The average cost of full coverage in California is $ per month. That's a significant increase over the national average of $ for full coverage. Full. California car insurance rates — quick facts · The average auto insurance cost in California is $1, per year — 20% more than the national average. · Drivers in. Car insurance averages about $2, a year for full coverage in California and $ a year for minimum coverage, according to Bankrate. Individual rates vary. Average Cost of Car Insurance by State. How much is good car insurance? How California. $ $ $ Colorado. $ $ $ What are the minimum California auto insurance requirements? · $15, in bodily injury per person · $30, in total bodily injury per accident · $5, in. Average full coverage car insurance in California costs 12 percent more per year than the national average. High insurance costs in the Golden State could be. Average Car Insurance Rates by Age and State ; California, $2, per year, $ per year ; Colorado, $3, per year, $ per year ; Connecticut, $5, per year. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. Several factors affect your car. California drivers pay an average of $ per month for full-coverage insurance and $ per month for minimum-coverage insurance, according to Insurify's. The average cost of full coverage in California is $ per month. That's a significant increase over the national average of $ for full coverage. Full. California car insurance rates — quick facts · The average auto insurance cost in California is $1, per year — 20% more than the national average. · Drivers in. Car insurance averages about $2, a year for full coverage in California and $ a year for minimum coverage, according to Bankrate. Individual rates vary. Average Cost of Car Insurance by State. How much is good car insurance? How California. $ $ $ Colorado. $ $ $ What are the minimum California auto insurance requirements? · $15, in bodily injury per person · $30, in total bodily injury per accident · $5, in. Average full coverage car insurance in California costs 12 percent more per year than the national average. High insurance costs in the Golden State could be. Average Car Insurance Rates by Age and State ; California, $2, per year, $ per year ; Colorado, $3, per year, $ per year ; Connecticut, $5, per year. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. Several factors affect your car.

Again, car insurance premiums increase after at-fault accidents go up 46% on average and potentially even more than that in California. Rate increases will go. The most recent assessment suggests that average insurance rates have gone from $1, annually in to $1, in for an increase of % over seven. For example, with Metromile you can get a California car insurance policy for a low monthly base premium that starts at only $29 per month. Then, you'll pay as. The average monthly cost for a full coverage policy in California is $ This type of policy includes liability insurance, as well as comprehensive and. The annual premiums in California vary by county, ranging from $ - $ There are discounts if the consumer has been a licensed driver for 3 years with a. Minimum California Car Insurance Coverage · Bodily injury liability coverage: $15, per person / $30, per accident minimum · Property damage liability. Again, car insurance premiums increase after at-fault accidents go up 46% on average and potentially even more than that in California. Rate increases will go. The average monthly cost for all USAA auto policies issued in California in See note1. Did you know? You can save up to 10% on your premium. The most recent assessment suggests that average insurance rates have gone from $1, annually in to $1, in for an increase of % over seven. Each city in California has different rates, and below, you can compare average rates with the national average. According to our data, drivers who live in. As an example, an insurance company's rate for automobile insurance might The California Department of Insurance is a regulatory agency and not an insurance. Nationwide, the average cost of minimum-coverage insurance is $ per year, while the average in California is $ per year. For full coverage, residents of. The average annual auto insurance rate in California is $ more costly than the average expense in Georgia. The precise cost will depend on your coverage. The countrywide average auto insurance expenditure rose percent to $1, in from $1, in according to the National Association of. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month.1 Keep. The average cost for California drivers for the basic minimum is $53 per month. The national average is $ When it comes to full coverage, the disparity. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month.1 Keep. On average, drivers who switched to Allstate saved $, so get your free auto insurance quote today! For a fast, free quote, call () Car Insurance Coverage in California. Is Car Insurance Required in CA? And as promised, the average cost of car insurance in San Diego is $3,, which costs you less than insurance in San Leandro, CA, where the average is.